Why Fractional C-Levels

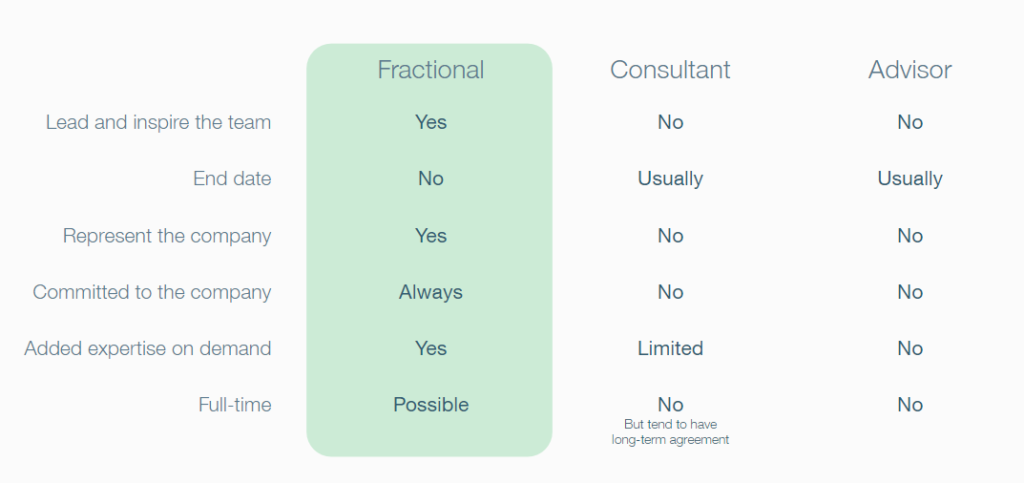

Hiring a fractional C-level officer is the most efficient way to implement the best industry practices and grow your business without the challenges of talent hiring and risks with broken commitment. Unlike advisors and consultants, fCFO engagement assumes a long-term and stable commitment to the company. The fCFO services are based on strong bonding with the company and growing it into a successful business, preparing and supporting the growth during VC stages and even IPO.

Yes, We Are Different

The fCFO is a trusted executive team member who works closely with the company but on a limited schedule. However, fCFO provides unlimited services and insights of the highly experienced officer who leads teams, empowers decision-making, and helps a company focus on its growth and success.

The fCFO services from Finops are different because, with a leading fCFO, you get the fCFO Team of experienced professionals who are ready to focus on specific goals and tasks like investor relationships, comprehensive financial modeling, and many others. Also, we have a network of CPAs, tax advisors, lawyers, and other professionals who are carefully selected to match your team and solve your challenges. Our services are comprehensive and we will help you to lower your costs for most of the professional services that many startups need.

How We Work

Each startup is different, and we understand it. That is why the proposed process gives a general review of how we work. Changes, especially during challenging times, can be painful; the team would not be ready for them, and already accumulated problems can include hidden risks. That is why your company’s action plan will always be adjusted to your needs and priorities.

We review the current status and needs of your business.

We interview and introduce ourselves to your team. We discover your company’s internal and external challenges and advantages during this process. As a result, we prepare the Action Plan for your financial department or company.

We introduce the Action Plan to the executive committee and propose several scenarios for its implementation. After approval, we begin the necessary changes for your company and track their effectiveness. If necessary, we adjust the process for a more efficient outcome.

Like a full-time CFO, we lead your team, improve its results, propose the most efficient solutions, and nurture your company by supporting your direction.